A Eulogy for The DAO

...or How I Learned to Love the Input Data Field…

…or How I Learned to Love the Input Data Field…

Introduction

In this three-part series, we analyze the nearly 170,000 transactions made against the ill-fated smart contract “The DOA” since its inception nearly five months ago. The DAO is dead. This series may serve as part of its eulogy.

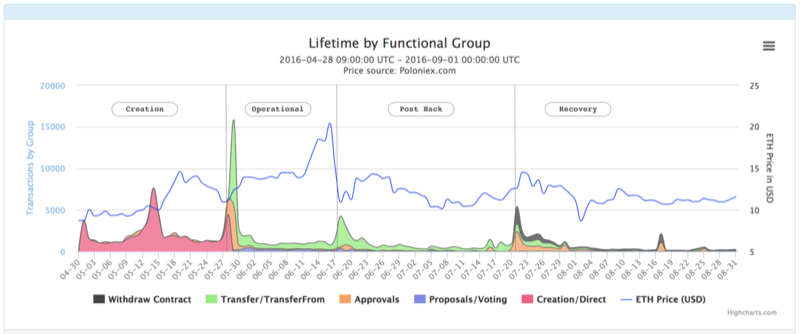

The DAO lived through four distinct time periods, each characterized by different user behavior, being (1) the Creation Period, (2) the Operational Period, (3) the Post-Hack Period, and (4) the Recovery Period. This first part of our series gives a broad overview of these periods and is followed in the coming weeks with two more installments presenting further details.

It is important to note, before we begin, that our analysis is a “work-in-progress.” There are three prominent areas of missing information: the moment-by-moment ‘ether’ balance of the contract, the inclusion of ‘internal transactions,’ and an analysis of ‘in-error’ transactions. This information is available, of course; but, to the best of our knowledge, it’s not available ‘quickly’ or ‘automatically.’ The primary focus of our project is the delivery of smart contract analysis and monitoring data — for any Ethereum address — in as quick and as automatic a way as possible. Delivering fast, interactive data for any smart contract is fundamental to what we are working on. Once this missing data is available quickly, we’ll bring it to you.

In the meantime, on with the analysis…

Four Periods of “The DAO”

The start of each of the four periods we’ve identified is signaled by an uptick in activity as can be seen by the green- and orange-shaded areas above. This analysis documents these spikes and proposes explanations for each. Access to further information about each period will be provided later in this series and is also available on the TrueBlocks website.

Following is a summary of each of the four periods we’ve identified:

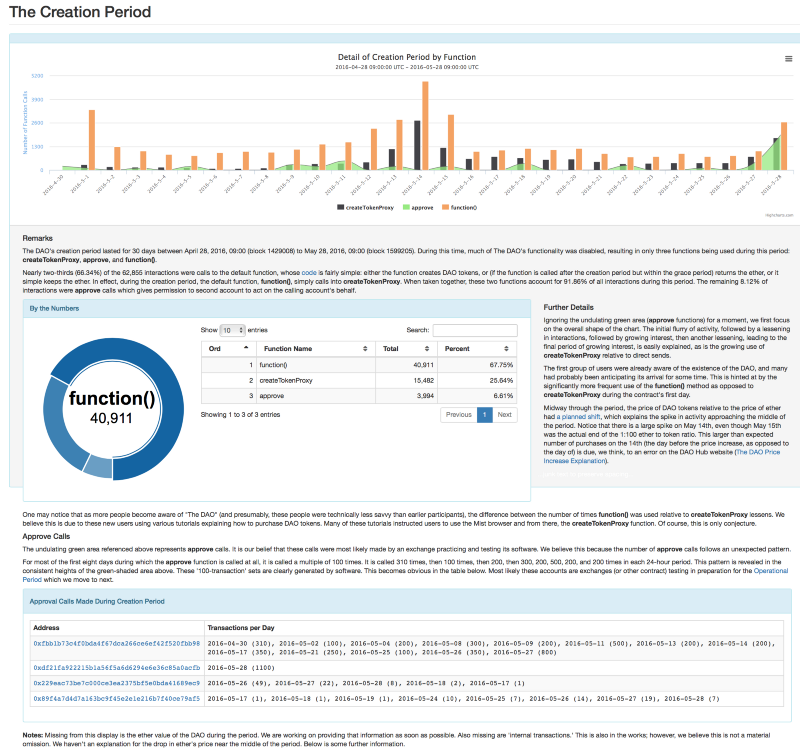

- The first period of activity (the pink section above) we’ve called the Creation Period. Noteworthy here is the spike in token creation on May 14th which was initially reported to be the last day of the 1:100 token price. A slightly smaller spike appears the next day, May 15th. The existence of this second ‘fantom’ spike is, we believe, the result of a mistake on the DAOHub website. Understandably, due to the excitement generated by the huge amount of ether attracted, a further spike in activity is seen at the end of the period.

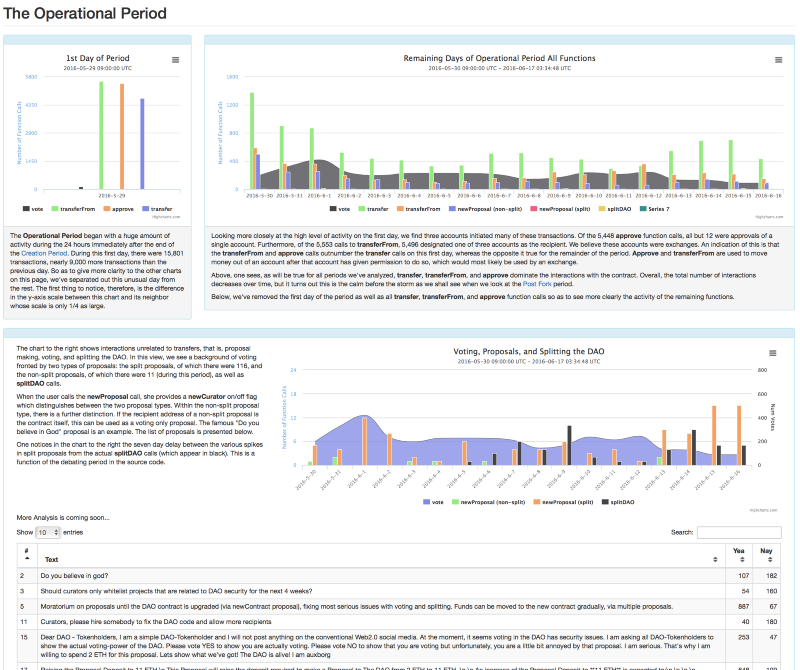

- A huge spike in activity, immediately after the end of the creation period, marks the beginning of the Operational Period. Many of the transactions in this initial spike come from three or four accounts (assumed to be exchanges). Notice the very small, blue area near the bottom of the chart during this period. This is newProposal and voting activity (for both split and non-split proposals). Proposal related activity and voting distinguish this period from the rest and are further discussed on the website.

- While significantly smaller, the next spike activitiy is an direct response to the hack on June 17th. This marks the beginning of the Post Hack period. After the initial flurry of ‘panic selling’, the period is characterized by relative quiescence and declining activity due, we believe, to uncertainty and an early direct instruction from ‘the white hat group’ to refrain from interacting with The DAO. Many of the non-transfer transactions during this period were initiated by the white hat group. The Post Hack period is also discussed further on the website.

- The final period we’ve identified, the Recovery Period, is marked by another spike in activity as well as the advent of the DAO Withdraw Contract. The start of this period corresponds with the hard fork. The interactivity pattern results from users reclaiming their ether through a two-step process of approval and then withdraw. After an initial spike, this withdraw activity quickly dies down as is discussed in this article.

- A possible fifth activity spike seems to have occurred on or around August 17th; however, we do not discuss this fifth period in this analysis.

Coming Attractions

In the coming weeks we will be expanding on and completing this three-part series of articles delivering our eulogy for “The DAO.”

To be honest we pushed this first article out a bit early because we wanted to finish it before DevCon2 in Shanghai. (We’re going!) If you wish to talk with us about our project, please contact us. In the meantime, here are two screen shots of coming attractions. We are busy analyzing and writing about each individual time period. We’ll have it out to you as soon as we can.

Conclusion

One may say one thing with certainty about “The DAO”: It was an amazing ride.

The initial excitement of a purely un-managed piece of software raising $150,000,000 US dollars in 30 days — in spite of there being no-one in charge — was exhilarating. Then, the disappointment of such meager voting. And then, on the morning of the hack, waking up to find that the price of ether had plummeted (along with my naive belief that it was possible to write an immutable, un-hackable code). Later, the way the community came together (sort of) and carried out the hard fork was inspiring, that inspiration only to be dashed by the zombie-like resurrection of the lesser chain we all incorrectly assumed would die a quiet death. It’s been an amazing ride.

On a personal note, I’ve enjoyed tracking the data generated by “The DAO” but I’m glad it’s over. My desire to “get at this data” gave me the impetus to develop the tools I’ve needed to feed my obsession (i.e. the TrueBlocks website and the EthSlurp software). I hope you’ve enjoyed reading this analysis. Please stay tuned and we’ll get you more.

If we can do anything for you — for example create an analysis/monitoring website similar to the one we’ve created here for your smart contract — please contact us. We’ll be happy to speak with you.

— — — Notes: The effect of the hack on the price of Ether is very obvious in the first chart, as is — a few days after the hard fork — the effect of Ether Classic not dying a peaceful death. All transactions represented on these charts exclude “in-error” transactions unless otherwise noted. “Functional groups” are further explained on the website.

To Do: (1) Display the total accumulated ether (and US dollar value) and DAO tokens on all appropriate charts. (2) Include ‘internal transactions’ in this reporting.